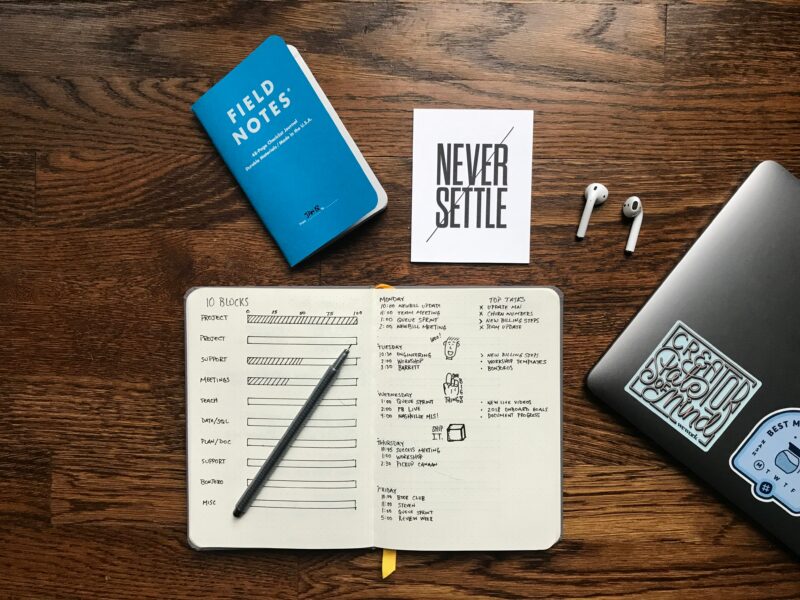

Learning ways to increase your income without working too much or compromising on work-life balance can be challenging. However, what if there were more competent, efficient ways to bolster our earnings without tethering ourselves to the clock?

Imagine unlocking the potential to earn more while maintaining a healthy work-life balance, allowing for more time with loved ones, pursuing passions, and simply enjoying life. Thanks to the age of technology and AI we live in today, the dream of financial freedom is not unattainable. It’s important to understand how you can truly leverage the tools we have at our disposal. Let’s explore seven smart ways to increase your income without working more hours.

Start a Side Hustle

Launching a side hustle is one of the most common and effective ways to supplement your income without committing to a traditional second job. Whether you prefer freelancing, selling handmade crafts online, or offering consulting services in your area of expertise, a side hustle allows you to leverage and build on your skills and passions while generating extra cash.

Monetise Your Hobbies and Skills

Do you have a talent or hobby that you’re passionate about? Consider monetising it! Whether it’s photography, baking, graphic design, or playing a musical instrument, you can turn your hobbies and skills into income streams.

Explore opportunities such as teaching classes, selling products, or offering your services to others. The best part about this approach is that you can do it from the comfort of your home. You can start an online course, an e-commerce website, or even sell digital products. The key is to take that first step and get started.

Rent Out Your Property or Other Assets

If you have extra space in your home, consider renting it out to generate additional income. This could involve renting a spare bedroom on platforms like Airbnb or even your entire home while you’re away on vacation.

Additionally, if you own a car or other valuable assets, you could consider renting them out when you’re not using them. Several apps in the UAE, such as FriendlyCar, allow you to earn up to 100,000 AED depending on the value of your car and how often you rent it out.

Invest in Dividend-Paying Stocks

Investing in dividend-paying stocks is a passive way to generate additional income without working extra hours. By purchasing shares in companies that regularly distribute dividends to their shareholders, you can earn a steady stream of income over time.

You can also invest in the S&P 500 or Nifty 500, where your investments are diversified among various stocks. This allows you to earn monthly dividends and minimise your risk. Be sure to research and choose dividend-paying stocks wisely to maximise your returns.

Take Advantage of Cash Back and Rewards Programs

Make the most of cashback and rewards programs from credit cards, shopping apps, and loyalty programs. In the UAE, there is a symphony of apps where you can earn cashback, discounts and rewards, such as Entertainer, TOTL, Groupon, and more.

By strategically using these programs for your everyday purchases, you can earn cashback, points, or other rewards that can be redeemed for gift cards, travel, or statement credits, effectively increasing your income.

Offer Online Courses or Workshops

If you have expertise in a particular subject or skill, consider creating and selling online courses or workshops. Platforms like Udemy, Teachable, and Skillshare make creating and selling digital courses easy for a global audience. This allows you to monetise your knowledge and expertise while reaching a broad audience of learners.

Negotiate a Raise or Promotion

Don’t underestimate the power of negotiating a raise or promotion with your current employer. Research industry standards for salaries and compensation packages in your field and prepare a compelling case based on your contributions and achievements for why you deserve a raise or promotion. Be confident and assertive in advocating for yourself and your value to the company.

The right strategies and mindset can increase your income without working more hours. Whether starting a side hustle, monetizing your hobbies, investing, or negotiating a raise, there are numerous avenues to explore to boost earnings and achieve financial stability. By implementing these innovative strategies, you can take control of your finances and work towards your financial goals.